Digital Finance

Digital Finance in Ethiopia's Informal Economic Segments

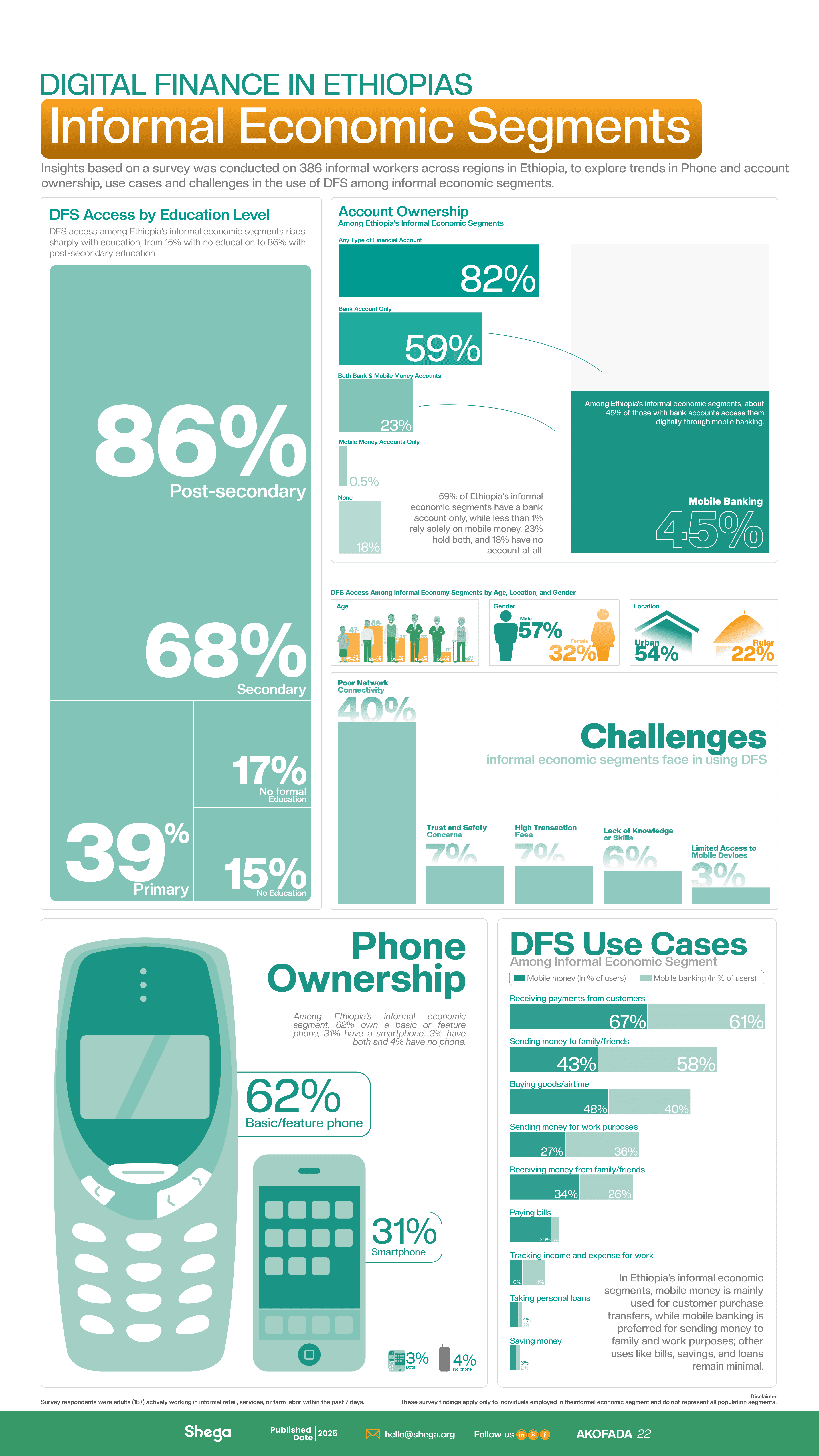

Behind Ethiopia’s informal economy are millions of workers navigating daily financial decisions, and access to finance, particularly digital financial services, is being embraced but unevenly. Education remains one of the strongest predictors of inclusion: while 86% of those with post-secondary education access DFS, only 15% of those with no education do. Phone ownership further shapes usage, with basic phones dominating at 62%, limiting how deeply individuals can engage in digital services.

Significant gender gaps persist, with men far more likely to access DFS than women, and rural communities continue to face added barriers. In terms of use case, informal workers rely on DFS for customer payments, personal transfers, and work-related money flows, while adoption of savings, loans, and bill payments remains limited, revealing both progress and substantial untapped potential for deeper financial inclusion.

Published By

--

Published On

29 November 2025