Loading...

Articles

Analysis and assessments on DFS

Infographics

Visuals produced by DFS

⏳

Go back in time

Explore our Insights archive and discover past publications.

Explore our Insights archive and discover past publications.

03 November 2025

08 October 2025

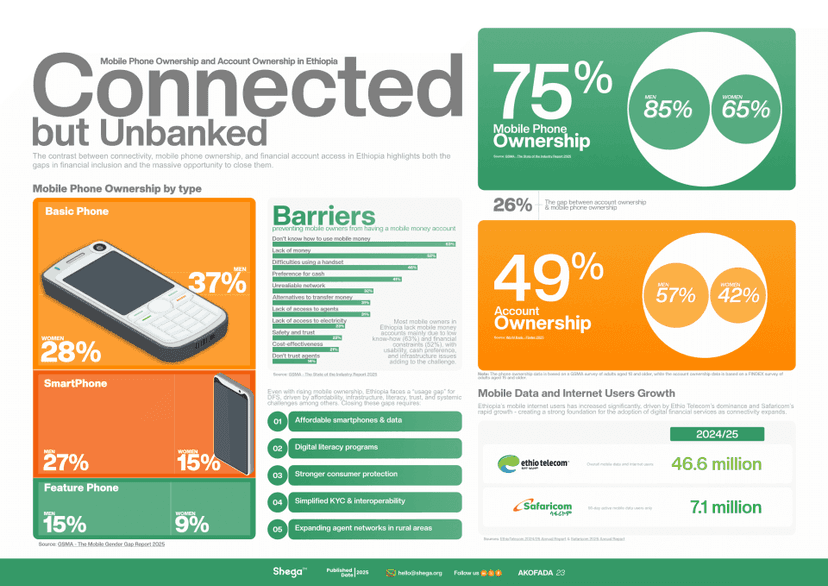

Ethiopia’s mobile money ecosystem is expanding, but adoption remains uneven. While most adults now own mobile phones and...

Ethiopia is experiencing one of the fastest digital connectivity surges in Africa — mobile internet users grew significa...

Behind Ethiopia’s informal economy are millions of workers navigating daily financial decisions, and access to finance, ...

Ethiopia now boasts over 540,000 reported agents, processing ETB 889 billion in transaction value and 125 million transa...